Reduction of custom duties, receive our complete guide!

For more information on reduction schedules, dismantling categories, GSP or calculation methods, please ask for our guide on tariff reduction.

Contact our teamImmediate exemption or reduction in 4, 6, 8 or 10 years? What is the category of your product? The EU tariff schedule or Vietnam tariff schedule ? What is the intermediate rate applicable to my product ?

All these questions are raised by the EU-Vietnam Free Trade Agreement (EVFTA) that is why the CCIFV, through its EVFTA desk, will try to answer.

The main benefit of the EVFTA lies in the fact that, over time, 99% of European and Vietnamese products will be exempt from customs duties. Current tariffs will be reduced to 0%, subject to certain conditions.

However, depending on the origin of the products, the base rate and the reduction schedule vary.

Indeed, due to differences in development levels, the EVFTA imposes a different reduction schedule for products originating from the EU compared to those from Vietnam.

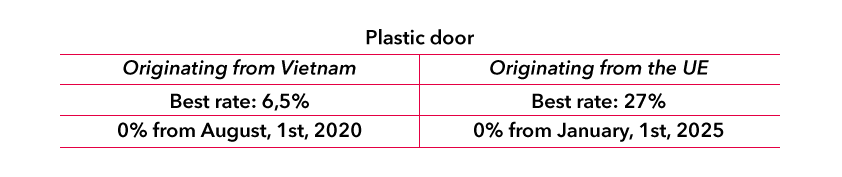

A plastic door produced within the EU and shipped to Vietnam is initially taxed at 27% while in the opposite way (VN → EU), the Vietnamese plastic door is taxed at 6.5%.

The entry into force of the EVFTA enables Vietnamese doors to be immediately exempted from any customs duty but in the other way - from the EU to Vietnam - the rate will be gradually reduced to 0% within 6 years.

This differentiation aims to avoid unfair competition by the immediate introduction of European products with advantageous prices in a developing Vietnamese sector, and vice versa.

The progressive reduction of customs duties will offer the parties a more or less long period to allow them to develop their competitiveness in certain sectors in order to face competition from the other party's products in the same sector.

To find out what the reduction schedule is for your product, both Vietnam and the EU have established a tariff schedule that identifies all products with the associated base rate - that is, the rate applicable before the entry into force of the EVFTA - and the category of the products, which is used to determine the tariff reduction schedule.

A Vietnamese company manufactures cotton blouses for women. This company wishes to export these products to France (VN → EU).

According to the EU tariff schedule, the base rate applicable to this product is 12% and the associated category is "B3".

This means that the customs duties will be decreased in 4 equal annual installments starting from the entry into force of the EVFTA.

Therefore, each year, the prime rate will be reduced by 3 percentage points to 0% within 4 years.

While some Vietnamese products already benefited from a preferential system - the GSP -before the EVFTA, European products were systematically taxed to rate base when they entered Vietnam.

Now, EVFTA offers European products a tariff advantage. This innovation allows a new development in the trade relationship between the EU and Vietnam.

The tariff advantages introduced by the EVFTA agreement include, notably, the preferences granted to European products and the options offered to Vietnamese exporters until the end of 2022. Until that date, Vietnam still benefited from the EU’s Generalized System of Preferences (GSP), allowing Vietnamese exporters to choose between the GSP and the EVFTA to secure the best tariff conditions.

Since January 1, 2023, the GSP is no longer applicable to Vietnamese exports to the EU, and only the provisions of the EVFTA now apply to eligible products. Currently, customs duties between Vietnam and the European Union continue to decrease gradually under the EVFTA’s provisions, with the aim of eliminating nearly all tariffs by 2030. This development strengthens trade relations between Vietnam and the EU, while data related to the GSP is now primarily historical and no longer applies to Vietnamese exports to the EU.

© Article written by the France-Vietnam Chamber of Commerce and Industry (CCIFV). Reproduction rights reserved. |

For more information on reduction schedules, dismantling categories, GSP or calculation methods, please ask for our guide on tariff reduction.

Contact our team